At the mid-point of the 2025-2026 hockey season

by Dale Henwood GBHA Advisory Council

At the start of the current hockey season, there was intense volatility in the roster of many teams as players were freely moving between three main leagues – U SPORTS, CHL and NCAA. The eligibility changes — most visibly the NCAA’s decision* (CHL players to be eligible to play NCAA hockey beginning in 2025-26 | NHL.com) to open Division I rosters to both U SPORTS and Canadian Hockey League (CHL) players and the broader transfer-era reforms that make moves between leagues easier — thus far they have already re-shaped recruiting, roster construction and the storylines in three separate but tightly connected development systems: NCAA Division I, U SPORTS (Canadian university hockey) and the CHL (major junior). The decision gives players more options as to where they choose to develop prior to entering the NHL or other professional leagues. The first half of the 2025–26 season has begun to show both the promise and the pain of this shift.

[* Effective August. 1, 2025, provided they were not compensated above actual and necessary expenses prior to enrolling in college, players who had skated in one of the three CHL leagues or U SPORTS were permitted to play NCAA hockey. Previously, CHL players had been considered professionals and barred because of the NCAA’s amateurism rules, in part because some CHL players have signed NHL entry-level contracts.]What has changed?

The NCAA relaxed transfer rules (notably the one-time transfer exception and follow-up updates) so eligible undergraduates can transfer and be immediately available, which in practice has removed many of the old “sit-out a year” penalties for moving between programs. That modernization has applied across NCAA sports including men’s ice hockey. The ability to compete immediately offers the utmost flexibility and support of the student-athletes and is seen as a positive step toward improving the overall experience and future success of the athlete.

Crucially for Canadian players, the NCAA Division I decision allows players with CHL experience (many still in the CHL and many more that have enrolled in U SPORTS programs) — who had long been treated as “professional” because of stipends** (College Hockey Inc » NCAA DI Council Votes to Make CHL Players Eligible) to retain NCAA eligibility as of the start of the 2025–26 season. That ends a longstanding wall between major junior and U.S. college hockey. The decision followed litigation and growing pressure over the past year.

[**Actual and necessary expenses are any expenses necessary or required for your participation in practice or competition, including but not limited to: meals, lodging, transportation, apparel, equipment, supplies, coaching, ice time, medical treatment (health insurance), and entry fees.]Positive Implications

A. For the NCAA

In summary, the NCAA immediately benefits from an expanded talent pool. CHL players — many of whom are top NHL prospects or soon-to-be pros — add more high-end depth and proven competition to Division I rosters. That raises the overall level of play and widens recruiting pipelines into U.S. campuses, which can attract bigger crowds, more TV interest and stronger NHL scouting ties. The NCAA also gains from the increased mobility of players. Teams can plug roster needs more quickly via transfers or by recruiting established Canadian university talent who no longer face a mandatory sit-out period.

Some specific implications.

- Bigger talent pool and improved depth. The CHL players should raise the level of competition, making the product even better.

- More flexibility for players and families. Canadian players now have real choices — they don’t have to choose at age 15-16 between CHL vs. NCAA. There is now a possibility new relationships can be developed with CHL and NCAA teams.

- More time for players to develop while pursuing education. Because CHL players can now shift to NCAA later, the pressure on young teens (14–16) to decide early may be reduced. This could lead to more balanced development (hockey and academics) rather than forcing a premature commitment.

- Recruiting and academic-eligibility complications. It is believed that many CHL players didn’t take the NCAA-approved core high school courses because they assumed NCAA eligibility was void; as a result, some may not meet academic eligibility, creating roadblocks for recruitment. This makes a (false) assumption that American schools have higher academic standards than Canadian schools.

- Uncertainty about long-term effects. Much is unknown so early in the new process, and while some CHL players are committing to NCAA, others (or future recruits) may return to CHL or Junior A, depending on how things shake out.

B. For USPORTS

In short, U SPORTS programs and the league will adjust, recruiting differently, scouting deeper among less conventional leagues or non-CHL paths, and leveraging Canada’s broad base of hockeyplaying talent and the attractiveness of staying at home.

Easier movement across the border and the new transfer realities give U SPORTS athletes greater options — a player who shines in Fredericton or Edmonton can now more realistically pursue an NCAA scholarship and immediate playing time. That boosts the perceived pathway U SPORTS offers and may increase recruitment of Canadian high-school and junior players who want both education and flexible pro-development options. For the Bears, keeping the Golden Bears identity front and center, while emphasizing that the lessons, toughness, and camaraderie last far beyond the hockey program, can have a recruiting impact.

Some possible implications:

- U SPORTS still offers a compelling “home-grown” alternative to the U.S. college route Not everyone is going to be attracted to the NCAA.

- U SPORTS may attract different players, but the depth of Canadian hockey talent remains a strength. There remain “plenty of players” in Junior A, lesser-known leagues, European leagues or among those who value staying in Canada for education plus quality hockey.

- U SPORTS programs can still compete. They can remain a “favorable destination,” based on quality facilities, scholarships, Alumni support and what they offer beyond just hockey to recruits. For certain types of players, U SPORTS may now appeal even more — e.g., those who want education plus hockey, or who prioritize staying in Canada.

C. For CHL Players

Individually, CHL players win choice. The binary “choose CHL and forgo NCAA” decision is gone; players can pursue major-junior development and still keep college options open or switch later if they want an education and a different development track. That should help players find the best fit for their long-term goals.

Some advantages:

- Improved Recruiting Pitch: “CHL No Longer Closes Doors”

For decades, CHL teams lost top prospects to the NCAA because signing a CHL agreement meant ending NCAA eligibility. Now, teams can say: “Come play in the CHL and keep all your post-secondary options open.” This removes a major barrier in recruiting elite 15–17- year-olds

- Ability to Attract More High-End U.S. Players

American players who avoided the CHL due to NCAA restrictions may now be more willing to sign, resulting in higher competition levels, more drafted players, and more cross-border interest in CHL teams.

- Stronger Retention of Younger Players

Families who previously worried about “closing the NCAA door” will now be more comfortable choosing the CHL over the USHL, prep schools or academy programs. This stabilizes the pipeline.

- Increased Player Development Reputation

If players can use the CHL as a springboard to the NCAA, CHL teams may be seen as a more flexible development path, a stronger option for late developers, and a path that adds variety to a player’s portfolio. This could improve the CHL’s image internationally.

- Potential New Relationship Models

CHL clubs and NCAA schools might share scouting intel, develop informal “fast track” partnerships, and coordinate on player development philosophies. This was nearly impossible before.

Negative Implications

A. For the CHL

Succinctly, the CHL risks losing some of its top recruits to NCAA programs that can now promise both development and education — and, in some cases, a clearer route to the NHL. The CHL’s unique selling point (fast pro-style minutes at 16–20 years of age) is still strong, but the guarantee that choosing major junior would exclude NCAA scholarships has vanished. Expect more aggressive recruitment battles and, for some franchises, a measurable hit to the talent base over time.

- Player Retention Risk: More Players Leaving Early

The biggest negative is that CHL teams could now lose 18-year-olds who want to re-set NCAA interest, goaltenders or defensemen developing later and “fringe” NHL prospects wanting more time. This could create roster instability.

- Competitive Balance Issues

If top players leave after 1–2 years, small-market CHL clubs will suffer more, rebuilding cycles become harder and trade deadline strategies become less predictable.

- Impact on Business Model and Attendance

CHL revenue depends heavily on star players, local heroes, and NHL draft hype. If players bolt to the NCAA, some markets might see weaker attendance, there may be fewer marquee names and media coverage may lessen.

- Increased Recruiting Competition From NCAA Teams

U.S. college programs will now scout CHL more aggressively, recruit CHL players during the season, and offer scholarship packages to players already on CHL rosters. This dramatically increases recruiting pressure.

- Pressure on CHL Teams to Offer More Education Incentives

To retain players, CHL clubs may need to increase scholarship packages, enhance postsecondary guarantees, create hybrid CHL–university pathways, and provide more off-ice development support. All these increase operational costs.

- Player “shopping” and instability

Agents may move players around more aggressively, such as: join a CHL team at 17, jump to NCAA at 19, return to CHL at 20 (if rules allow), and jump to pro at 21. CHL teams may face more frequent lineup turnover and less roster predictability.

B. For USPORTS

While U SPORTS players gain mobility, the league also faces potential churn. Traditional top U SPORTS performers (Golden Bears, UNB) have been poached by U.S. programs mid-career, and the new transfer culture can complicate roster continuity, player loyalty and long-term program building for Canadian schools. That said, U SPORTS schools that emphasize academic supports, strong campus experiences and engaged Alumni could mitigate some of those losses.

- Drop in available top-end recruits (especially ex-CHL players). Historically, CHL graduates have formed a substantial portion of high-end U SPORTS roster recruits.

- Recruiting becomes more competitive — U SPORTS now competes not only among Canadian universities but with U.S.

- Risk of talent drain, especially of “top-tier” players meant for pro/NHL trajectories — The most elite guys — or those with professional ambitions — may be more likely to pick NCAA, meaning U SPORTS might, at least temporarily, mostly receive “second-tier” players or those prioritizing education over a pro career.

- The recruiting playing field may shift in favor of NCAA for players wanting both high-level hockey and earlier exposure to NHL prospects/scouts. Because NCAA gets a sudden influx of CHL-trained players, and because NCAA programs often have more resources, exposure, and scouting connections than many U SPORTS programs.

Essentially, U SPORTS teams could see the rule change as a threat to their traditional talent pipelines. The uncertainty and competition from NCAA could make recruiting and maintaining high-quality rosters more difficult — at least initially.

C. For the NCAA

More immediate eligibility and more applicants coming from CHL/U SPORTS raise complex roster and scholarship management issues. Coaches must integrate older, pro-experienced players into team culture and balance development opportunities for younger players. There is also concern about an arms race for elite Canadian talent, with power programs soaking up the best players and widening competitive gaps.

- Reduced opportunities for American-born players — While the new ruling increases the talent pool, it could limit roster spots for U.S. players.

- Unintended consequences — roster disruption & displacement — There could be many team rosters that look unrecognizable in just a season or two. That raises concerns about displacing incumbent players (especially role players) in favor of incoming CHL.

Across NCAA campuses, coaches reported a flurry of new recruiting activity and some immediate impacts on depth charts. Early-season games have featured ex-CHL names and transfers, and some programs that pivoted quickly to recruit CHL and U SPORTS standouts have shown improved firepower. Analysts are already flagging roster volatility — more midseason moves and a faster turnover of personnel — as coaches and players adjust.

How has the season’s first half looked?

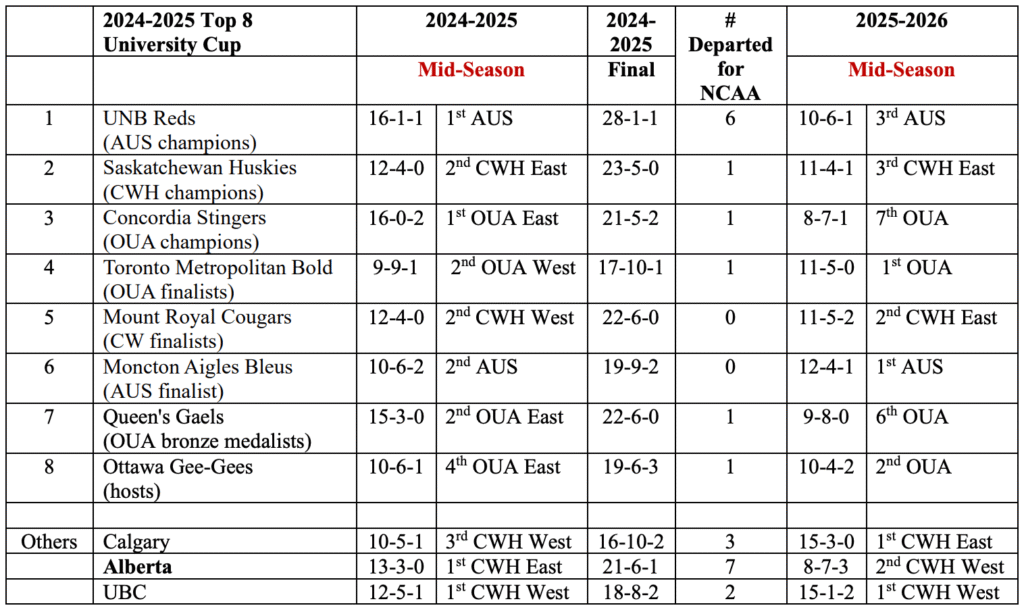

As of the Christmas break, the early 2025–26 campaign shows a mixed picture. U SPORTS remain competitive and deep: traditional powers retain heft — the UNB Reds no longer atop national U SPORTS polls (as of December 8 th) but looked strong in early conference play — a sign that university programs are adapting and still recruiting well. The chart below depicts the records of various teams in 2024-25 versus 2025-2026 and the departures to the NCAA. When comparing the year over year records, is there a correlation, a causation or just a coincidence?

A deeper look at our Alberta Golden Bears

Historically one of Canada’s blue-blood university programs, the Bears have had a more up-and-down start. Their official schedule and cumulative statistics reflect a team that is competitive but certainly not invincible; early season losses to conference rivals and some lopsided results show the parity growing across Canada West. In short: Alberta is still a heavyweight historically, but the blanket dominance of the past has significantly softened this season.

Historical records indicate no Golden Bear team has been under .500 at Christmas. This season’s team is technically not under .500 at 8-7-3, as the OT losses count as a point. However, if we change the OT losses to a loss then the Golden Bears are 8-10-0 at the break. A striking deviation from three decades of consistent national contention. The 8-10-0 record is the record that should count.

The last time the Golden Bears finished below .500 for an entire season was in 1994-95, when they went 11-12-5 (W-L-T) in 28 games. That team, under Peter Esdale, was 6-5-3 at the Christmas break and did not go below .500 until the 23rd game of the season when their record stood at 9-10-4. Alberta would finish that season at 11-12-5.

There were two other seasons in which the Golden Bears finished with an under .500 record. Alberta went 10-14-0 in 1980-81 (4-4-0 at the break) and 11-13-0 in 1981-82 (5-3-0 at Christmas break).

While the record is the most obvious indicator, a deeper look reveals a mix of structural challenges, roster disruption, and performance inconsistencies that have contributed to an uncharacteristic first half. The Golden Bears have historically benefited from mature, experienced rosters built around major junior (CHL) graduates. This year, the destabilizing effects of broader national roster movement—U SPORTS ↔ NCAA ↔ CHL—created unusual turnover and delayed continuity.

Golden Bears have traditionally excelled at reloading, not rebuilding, but the new ecosystem disrupted the Bears’ typical advantage in recruitment stability. The 2025–26 roster features several emerging leaders but fewer established fourth- and fifth-year anchors than usual. With notable departures in the previous off-season, the dressing-room dynamic shifted.

The Golden Bears’ mid-season record is an anomaly, but not a crisis. The team does not lack talent; it is lacking the continuity, chemistry, and hardened identity that typically define Golden Bears hockey. Structural change in the national player pipeline, combined with youth and early-season inconsistency, has magnified every small mistake.

The broader picture: a more fluid development ecosystem

The eligibility changes mark a structural shift: the three pathways (major junior, U SPORTS, and NCAA) are now less siloed and more fungible. That is great for individual players who want choice, but it raises difficult tradeoffs for institutions that must now compete harder for talent, manage short-term roster churn, and re-think long-range player development.

- The line between “college pathway” and “major-junior pathway” is blurring. Rather than forcing kids to choose as teenagers, many — especially in Canada — may now use CHL exposure and then shift to NCAA after assessing their development.

- NCAA Division I hockey could become more competitive and deeper, which might increase its attractiveness to NHL scouts and further shift the pipeline balance.

- CHL, Junior-A leagues, and other junior-level programs may have to adapt rapidly: better education, different recruitment strategies, and possibly new retention efforts to avoid losing top-end talent to NCAA schools once CHL becomes just another stepping stone, not a “oncein-a-lifetime” decision.

- The change may create tension (or at least competition) between American-born players and imported Canadian major-junior graduates for roster spots — something U.S.-based programs will need to manage carefully to preserve opportunities for domestic talent.

If the first half of this season is any guide, parity is increasing and recruiting intensity has spiked. UNB remains a force in U SPORTS (even with a record of 11-7-0 or 10-6-1) and Alberta (8 wins 10 losses or 8-7-3) remains a program of stature — but both will need continuous adaptation to retain top recruits and to manage transfers. Expect the off-season and recruiting cycles ahead to be busy, and for the hockey landscape to keep re-balancing as schools and leagues respond.

What are some USPORTS adaptation strategies?

- Casting wider nets in recruitment. Looking more aggressively at Junior A leagues, lesserknown leagues, or players outside the conventional CHL-to-U SPORTS pipeline.

- Promoting the non-hockey advantages: staying in Canada, combining hockey with Canadian education, being close to home, and emphasizing student-athlete balance.

- Emphasizing that U SPORTS isn’t just about “Plan B” — for some players, U SPORTS is legitimate end – not just for those who did not go to the NCAA or pro – especially when they value academics, community, and long-term life plans beyond pro hockey.

- Flexibility. Coaches will need to carefully watch how things evolve and adjust recruiting depending on how many Canadian juniors actually take the NCAA route, and how many choose U SPORTS.

What this might mean for U SPORTS — shorter term and long term

- Short to medium term: A likely dip in the number of CHL-graduate recruits, especially those with high-end upside or NHL ambitions. This could make some U SPORTS programs lean more heavily on lesser-known players, Junior A prospects, or players who want to stay in Canada for school.

- More competition for recruits among U SPORTS programs. As the supply of top-tier Canadian junior talent shrinks, U SPORTS schools might have to compete more fiercely among themselves for the remaining players.

- Potential repositioning of U SPORTS — emphasis on education and hockey and Canadianuniversity life rather than being “second-best” to NCAA. If U SPORTS schools double down on their unique selling points (Canadian education system, home-country convenience, balance of academics and athletics), they will attract players who value those more than chasing pro-hockey or NHL paths.

The Future

While not great at prognostication some likely scenarios for U SPORTS are offered.

1. Short-term roster turbulence and a noticeable drop in top-end talent. Probability: High

What does this look like:

- Fewer CHL graduates choose U SPORTS immediately out of junior.

- Some current U SPORTS players (especially first and second year) transfer to NCAA Division I – more lineup turnover.

- The “average skill level” of the league dips slightly but noticeably, especially at top programs.

- D-I coaches have explicitly indicated they are going to mine CHL and U SPORTS rosters heavily for 1–2 years.

- Initial observations suggest the traditional CHL to U SPORTS pipeline is “shrinking” so there is more pressure on U SPORTS coaches to find “hidden gems.”

2. U SPORTS recruiting shifts dramatically—Probability: High

What does this look like:

- U SPORTS will lean more heavily on Junior A and older players, European juniors, or young pros, CHL depth players (bottom-six or overage players not targeted by NCAA) and NCAA drop-downs (players leaving D-I because of limited roles). This could result in a slightly older, perhaps less flashy, but still very competitive league

3. Top U SPORTS programs remain strong — the middle weakens – Probability: Medium

What does this look like:

- The “U SPORTS superpowers” (UNB, Alberta, Saskatchewan, Calgary, Toronto, Mount Royal, Moncton, UQTR, St. FX, McGill) will remain competitive because they can offer better scholarships, recruit nationally, provide more professionalized environments and attract NCAA and CHL transfers who still want to be close to home and place players into pro opportunities (AHL, ECHL, Europe).

- Top teams will remain excellent, middle-of-the-pack teams become thinner and the competitive gap increases. This mirrors what happened in U SPORTS basketball and volleyball after past eligibility shifts.

4. U SPORTS programs lean harder into “education + hockey + Canadian identity”. Probability: Medium

What does this look like:

- Many U SPORTS teams are already messaging that: “Not everyone wants to leave Canada” and “Some players prioritize education first.”

- There will be more academic-focused recruiting pitches, stronger alumni/mentor networks (because they matter more) and more emphasis on life-after-hockey pathways. These become key differentiators versus NCAA programs offering short-term athletic opportunities.

Bottom Line:

Gone are the rules that once kept the athlete pathways separate, and players are now exploring multiple paths for development. The NCAA rule change has shocked the hockey landscape, and it continues to reverberate. It is early to draw too many conclusions, and it is likely 2-3 years before the flow of players stabilizes and the real impact is seen.

U SPORTS men’s hockey is not going anywhere — but it will look different. In the near term, there will be slightly fewer CHL stars, more Junior A and older players, increased emphasis on academics and Canadian identity. There will also be a wider performance gap between top and middle programs, (resurrecting talks about a Top 10 U SPORTS Division), and continued competitiveness internationally and in pro development. The league’s ceiling remains high, but its composition changes.

For the Bears, The University of Alberta Golden Bears will remain one of the top 1–2 destinations in Canada, even in a disrupted recruiting market. The core advantages — brand, history, Alumni engagement, winning culture, NHL/Europe connections, strong academics, and Alberta’s local hockey depth, keep them highly competitive even as the CHL to U SPORTS pipeline shrinks.

The biggest change sees the Bears developing a more diversified recruiting strategy, stronger relationships, and proactive retention strategies to avoid losing top players to NCAA poaching.

Alberta will remain a consistent national contender. There will be a slight dip in elite incoming talent from CHL, but not enough to weaken competitiveness. The Bears could become even stronger relative to most Canada West teams because of Alberta’s resources, culture, and reputation outweigh competitors while mid-tier Canada West programs suffer greater talent loss to NCAA.

For those in the GBH family that have watched the team this season, what are your impressions? What has changed if anything? Has the parity been disrupted? Share your observations and thoughts.